Why the Solar Tax Credit is 2025’s Hottest (and Soon-to-Vanish) Incentive

The Solar Tax Credit has been America’s most powerful tool for encouraging clean energy adoption since 2005. But in 2025, it faces a political sunset that could turn this solar dream into a missed opportunity.

With the latest Senate bill proposing an immediate end to the solar tax credit and even imposing new taxes on clean energy projects, homeowners and businesses across Massachusetts, New Hampshire, Maine, and Connecticut have a narrow window to act. If you’ve ever thought about going solar, now is not the time to stall. It’s the time to save.

What is the Solar Tax Credit?

The Solar Investment Tax Credit (ITC) is a federal incentive that allows you to deduct 30% of your total solar installation costs from your federal income taxes. This includes not only the solar panels but also labour, permitting, equipment, and even energy storage systems, such as batteries.

In practical terms, if your solar installation costs $25,000, you could receive a tax credit worth $7,500. That’s real money, not just a deduction. It’s a dollar-for-dollar credit against what you owe the IRS.

And yes, it applies to both residential and commercial solar systems.

Why the Solar Tax Credit is Under Threat

A new Senate budget bill, introduced in late June 2025, seeks to:

- End solar and wind tax credits immediately

- Impose a new tax on clean energy projects starting in 2028 unless they can prove zero Chinese-manufactured content

- Offer new subsidies for coal

- Accelerate the phase-out of domestic manufacturing incentives from the Inflation Reduction Act

This isn’t just a policy change. It’s a tectonic shift in how America funds its energy future.

So, What Does This Mean for You?

- Solar installations will become significantly more expensive

- Fewer incentives mean more extended payback periods

- Projects started after this year will not qualify for the 30% credit

- Higher utility bills as clean energy development slows

In other words: Act now or pay more later.

Solar Tax Credit Benefits: Dollars and Sense

According to the Solar Energy Industries Association (SEIA) and the Brattle Group:

- Solar tax credits save U.S. consumers $51 billion per year

- For every $1 spent in tax credits, taxpayers save $2.67 in return

- Cutting solar credits could increase residential electricity bills by 7% and small business bills by 10%

- The solar industry adds $75.5 billion to the U.S. economy annually

So yes, while critics argue the tax credits “cost” $25 billion a year, the return more than doubles that investment—kind of like buying a cup of coffee and finding a twenty in the bottom of the mug (minus the caffeine jitters).

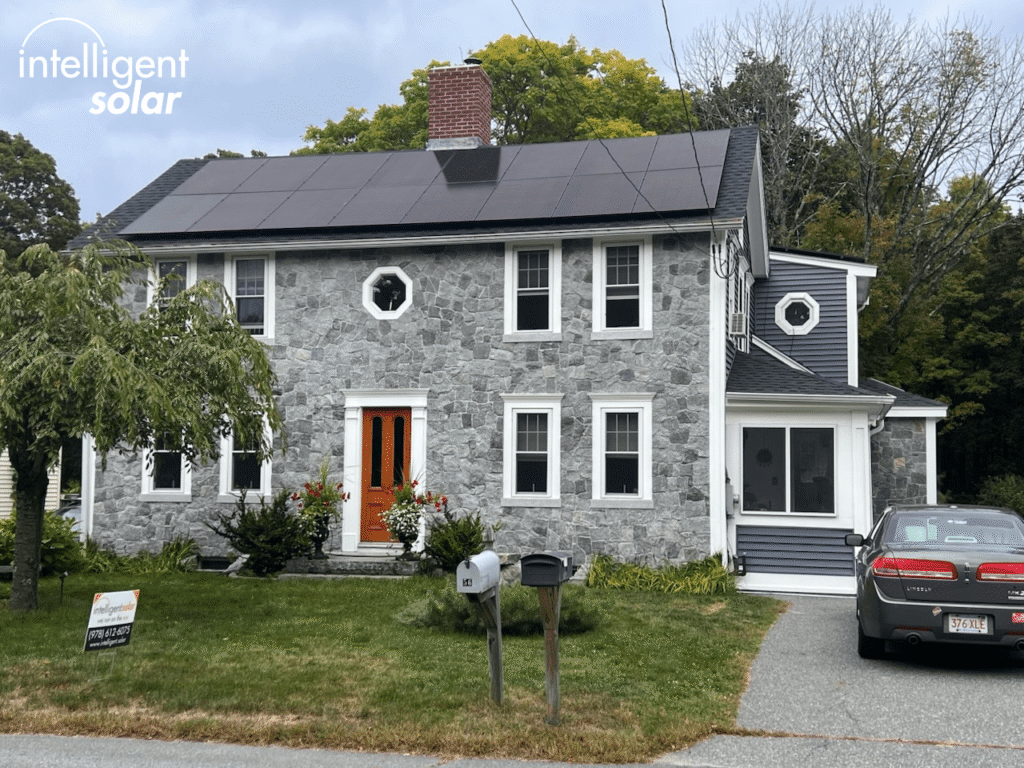

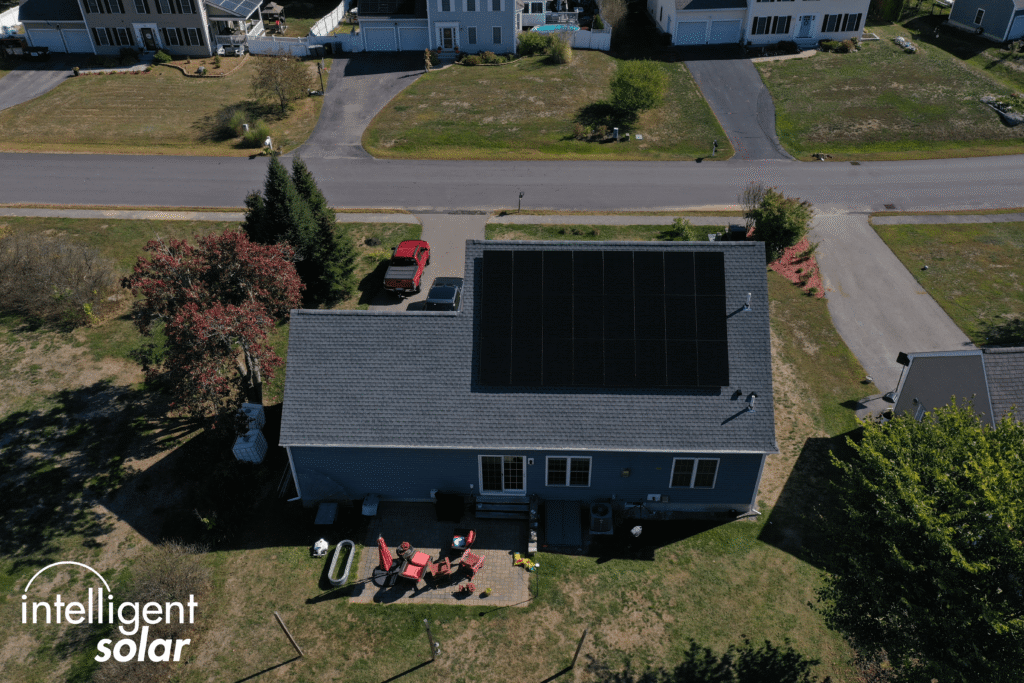

Intelligent Solar: Your Guide to Solar Savings in a Changing Landscape

At Intelligent Solar, we deliver smarter, faster, and fully customized solar solutions across Massachusetts, New Hampshire, Maine, and Connecticut.

We’ve helped hundreds of homeowners and businesses navigate the world of solar incentives, federal programs, and rebate stacking, and we’re ready to help you secure the Solar Tax Credit before it disappears.

Tailored Solar Solutions

We build your system around your roof, your goals, and your energy usage, avoiding cookie-cutter layouts and sales upsells.

Fast & Professional Installation

Our crew of professional licensed and experienced installers will install your system quickly and efficiently with state of the art equipment and a potitive attitude!

Battery Storage and Monitoring

Want backup power during outages? We offer energy storage systems that also qualify for the tax credit if done with solar, but also have their own special battery incentives – because solar savings shouldn’t go dark when the grid does!

Time Is Running Out Here’s What You Should Do Next…

With the Solar Tax Credit possibly ending as early as this legislative cycle, every week counts. Once it’s gone, it’s not just the credit you lose; it’s also your last chance at energy independence and long-term savings plus the added value to your home.

Ready to act before Congress pulls the plug? Intelligent Solar is here to help!

Speak with one of our dedicated solar experts for a free educational, no-obligations solar assessment for your property and tax credit eligibility review.

The sun is finally starting to set, so don’t miss out on your last chance at a stellar view with some savings to go along with it. Don’t wait!

Frequently Asked Questions About the Solar Tax Credit

Is the Solar Tax Credit still available in 2025?

Yes, as of now, homeowners and businesses can claim a 30% tax credit for qualifying solar installations. However, proposed legislation may soon end this incentive, potentially as late as 2025.

Can I still qualify for the Solar Tax Credit if I finance my solar system?

Absolutely. Whether you pay upfront or through financing, the tax credit still applies as long as you own the system (not lease it).

Do batteries or energy storage systems qualify for the tax credit?

Yes! Under current law, energy storage systems installed with your solar setup are eligible for the 30% tax credit. This includes lithium-ion home battery systems.

How long does it take to install solar with Intelligent Solar?

We specialize in fast, professional installation. Most residential systems are installed and operational within 4 to 6 weeks, depending on permitting and inspection schedules.

What happens if the tax credit is repealed after I’ve signed a contract?

If your contract is signed and installation begins in 2025, you should still qualify under current rules. We stay up-to-date with all regulatory changes to ensure you get every benefit you’re entitled to.

In Summary: The Solar Tax Credit Is the Best Deal in Energy But It’s on the Chopping Block

The Solar Tax Credit is more than a discount. It’s an investment in your home, your wallet, and the planet. However, with new legislation threatening to eliminate it, procrastination comes at a price.

Choose Intelligent Solar to make your transition to clean energy smooth, innovative, and financially rewarding. We’ll guide you through every panel placement, every form filed, and every watt saved so you don’t just get solar; you get solar done right.

To speak with a consultant or schedule your free site assessment, please reach Intelligent Solar by phone at (978) 472-2865 or email us directly at sales@intelligent.solar. We proudly serve homes and businesses across Massachusetts, New Hampshire, Maine, and Connecticut, and we’re ready to make solar simple and stress-free for you.